Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Your regular motor insurance policy is of little use if you have to replace plastic, glass or rubber parts after an accident. For example, if the windshield of your two-year-old car were to be replaced, you may get only Rs 2,500 from the insurance company. A new windshield would cost you around Rs 10,000. However, you can overcome this problem if you go for car insurance with added benefits like zero depreciation, engine protection and return to invoice. "Spare parts in high-value cars are costly. We recommend people with cars costing upwards of 10 lakh to go for add-on covers, as it will lower their risk," says Arvind Laddha, CEO, Vantage Insurance Brokers.

|

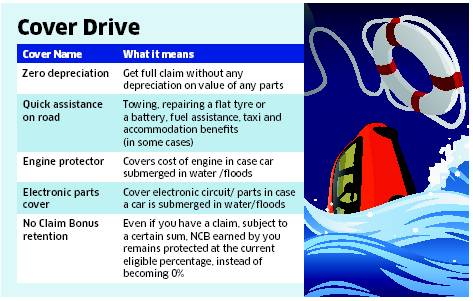

Zero depreciation

This add-on cover ensures that you will receive the full claim without any depreciation on the value of parts that are replaced after an accident. "In case of a major accident, a zero-depreciation policy could come in handy," says Niraj Jain, CEO & Principal Officer, Insurancemall - an online insurance portal. "Remember to buy the zero-depreciation cover in the first year itself, as an insurance company could deny it in the second or third year or ask for a heavy premium," adds Niraj Jain. If your bumper gets damaged and it costs Rs 15,000 to replace it, most insurance companies would merely pay around Rs 7,500. However, if you have a zero-depreciation cover, you could get the entire amount back. Most insurance companies offer it for vehicles that are less than three years old. Get an add-on motor cover for a smooth cruise this monsoon If you were to meet with an accident in an unknown area where a basic service centre is far away, this add-on could be handy. "The facilities included under this would include towing, repairing a flat tyre or a battery, fuel assistance, taxi and accommodation benefits," says Vijay Kumar, chief technical officer, Bajaj Allianz General Insurance

Engine and electronic circuit cover

During monsoon, chances of flooding in many areas cannot be ruled out. If you start your car while it is still submerged in water, the engine could get badly damaged. Since the engine is one of the most crucial parts of a car, repairing it is a costly affair. Trying to start the car repeatedly may cause further damage and it may finally break down. This phenomenon is known as hydro-static lock, and as per experts, is one of the most common reasons for vehicle engines to get damaged during monsoon. "Such damage is not payable under a regular motor insurance policy. You may have to call the towing agency or the insurer who can arrange to tow the vehicle. An add-on such as engine protector may cover such specific claims," says Vijay Kumar. Same is the case with electronic circuits. "In case of water logging, it is not one or two parts, but the entire circuit may need to be replaced. This cost could be very high, and hence, an add-on policy which covers electronic parts could help," says Rahul Aggarwal, CEO, Optima Insurance Brokers.

Return to invoice

This benefit is available only in the first year of buying a car. In case the car is totally damaged, 100% of the value of the vehicle (without deducting 5% depreciation) is reimbursed.

NCB Retention

No claim bonus is a reward for those policy holders who have not registered any claims against their car insurance policy in the past. Over a period of time, this bonus can be accumulated to claim a discount of up to 50%. However, even a single claim on your policy can bring this down to 0%. By buying an add-on cover, this can be avoided. Under this add-on, even if you have a claim, subject to a certain sum, NCB earned by you remains protected at the current eligible percentage, instead of becoming 0% under a normal policy," says Banwari Lal Sharma, AVP (Marketing), Carwale, an online automobile portal.

Many add-ons are bundled as a package by insurance companies. If you end up buying all of them, your premium will increase substantially. "Understand what you need the most and buy accordingly," says Banwari Lal Sharma.